Saying goodbye to January and a welcome to February.

After a day or two of feeling considerably yuck, and just when I thought I had shaken off the worst, the virus decided it would linger a little longer. So I had to linger a little longer with it, sometimes on the sofa and sometimes I just gave in went back to bed and slept…the clock round in one instance.

I fully expect this was a reaction to not eating properly or getting to bed at a decent hour for a number of weeks on and off. My body was not going to wait any longer and decided an enforced rest was necessary.

I was disappointed though. At the start of the week, I had planned to embrace my patiently waiting task list, and suddenly and abruptly my plans were cut short as the cold rapidly took hold. At least I managed to go for my blood tests on Friday morning, so not all was lost.

The weather is pretty dismal here; blanket grey skies with an enveloping fog that is always lurking in the background. Drizzle competing with snow, and cold – always cold, so anything bright really stands out like the little red berries on our cotoneaster horizontalis outside the window.

There are other small flashes of colour too – the pretty pale yellow petals of the primulas poking over the tops of the terracotta pots dotted about the garden.

Still I have nothing against January, or February. I welcome the slowing down after Christmas, and like a crab scurrying away into its shell (I am a Cancerian), I love to retreat into my snug, warm home for a few weeks getting ready to emerge when the brighter weather beckons.

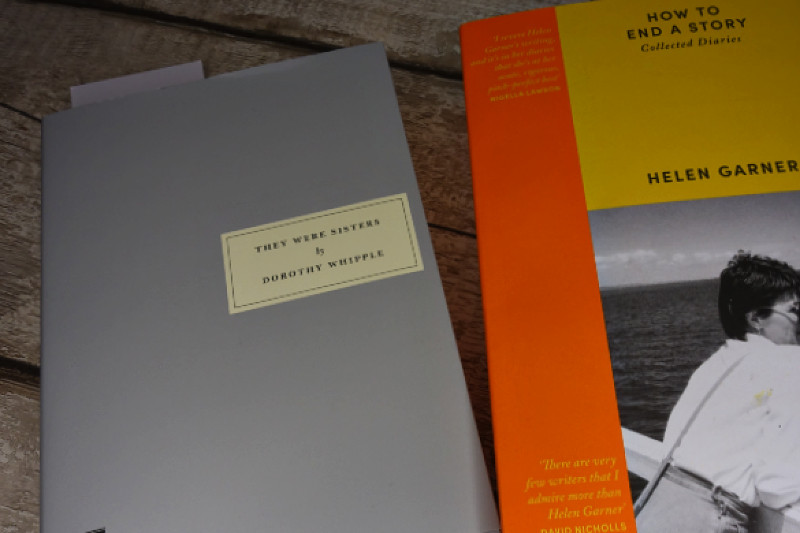

In my more lucid moments I have been reading and watching. Reading the Persephone book DH bought me for Christmas‘They were sisters’ by Dorothy Whipple – an engaging read but never expect an absolute happy or conclusive ending with her books, they often leave you with hope that situations might improve for the characters, but nothing more. She tells a good story though.

There is a film too from (1945) I might browse the Talking Pictures channel just in case they have it listed. We are not sufficiently in this century to have a paid TV subscription like Netflix – it would not be a good use of our money. We never had a TV at the cottage in Scotland and I actually preferred not to have one. On our earlier visits we didn’t have a phone or the internet either and were sufficiently cut off from the world to just absorb the peace and quiet. But then the longest we stayed there was only 3 weeks and most often it was only a week or weekend.

I will soon be starting the epic ‘How to End a Story‘ the collected diaries of Helen Garner but not before I have a browse through some of my recent library requests, ‘Unprocess Your Life’ by Rob Hobson, ‘Just One Thing’ by Michael Mosley and ‘The Doctor’s Kitchen’ by Rupy Aujla all in preparation to begin my next project of restoring our diet and health this month.

On the watching side, we have been viewing The Great Pottery Throwdown, Landscape Artist of the Year and the Agatha Christie adaptations on BBC iPlayer. I am also a fan of Art of the Garden on the Freeview Sky channel. I suppose anything with art in the title will always catch my attention.

We are pondering another art workshop, this one being held at a cheese and wine tasting venue in a neighbouring small town of Brighouse. An odd place for a painting and craft workshop (and there is no wine or cheese included) but they are making use of their room whilst it is not been used for tasting sessions. There is a social session and an artist led session to choose from.

Our idea is to jump in the car one day soon and check the place out before committing….and I will sneak in a visit to one of my favourite places – the large independent Boyes department store for a mooch around. You can always count on them to have something that you never knew you wanted and all at affordable prices. And yes, I do keep telling myself I shouldn’t even cross the threshold to avoid any temptation.

So how did my financial review last month go?

I spent as much time as I could in January addressing our financial position and fashioning a new budget for the year using last years figures, increasing them by a 10 or 20% margin to allow for the continually rising prices.

Once all the interest payments from our ISA savings have been accounted for we will be a few pounds richer. It always feels good to see the pounds increase when normally, all we experience, is the monthly decrease of our pension income.

I received the Vinted sales report for last year – a tidy £171 acquired on clothing items sold. Most of this is actually going to my daughter for the clothes she had accumulated but didn’t have time to sell herself. It is unfortunate she has not yet regained her pre-pregnancy size and these lovely clothes were languishing unworn in her wardrobe. Not all the clothes were advertised on Vinted as I took a lot to the charity shop as well so they didn’t miss out.

But we have yet to have the boiler service (next week), a probably large dental bill (postponed for 2 weeks), and we have a holiday upon us for a week on the North Yorkshire coast. A whole week looking out over the sea…I can’t wait.

Having a quick review of the housekeeping we managed to keep it down to just over £290 for the month, so I am pleased with that. It would be amazing to keep it at that figure every month, but I have to be realistic and I was starting January with a lot of stock in the pantry. Ideally, I would prefer to keep only ‘one in hand’, or ‘replace one as I use one’ but I have to be realistic and being ill, together with the bad weather, I realise I do need to keep the pantry well stocked for the first 3 months of the year at least as it gave us something to fall back on when we couldn’t get to town.

But yes, the coffers are definitely looking good so far this year.

Not being well enough for a trip to town, I did as maybe we should all do (and I know many of you already do) shop local. But really, a tin of non-organic Heinz baked beans £1.77 from the Co-op (I had to read the price label twice), I didn’t even look at the price of the loaf, courgettes and mushrooms, just offered them up at the till and paid by card.

I desparately needed a small present for my friend’s birthday too. The present box is currently empty, so after leaving the doctor’s surgery on Friday I had to find something in the village amongst the beauty parlours, dog parlours and turkish barbers (like everywhere we are short on proper shops now).

I completely forgot about the gift shop along the main street and had decided on a cyclamen from our lovely florist. But when we got there the cyclamens were on display outside and decidedly limp from the drizzle. It is the tiniest shop but she has one or two gifts inside and I spotted just the thing, these tiny mice. I bought an extra one while I was there to keep in the present box. I know my friend will love it as it is the sort of thing she would gift to me.

I delivered it to her doorstep and declined to go inside – so as not to spread my germs.

Of course just lying down not being able to participate in real life for a few days left time for thinking and daydreaming….. and thinking and daydreaming of organising and running our home. Some readers will know that I am very much a fan of Lean and using Lean methods to run my house. It is a system developed by Toyota in Japan many moons ago, and in my mind there are many good things practiced by the Japanese and Lean is one of them. It is a system I used at work with my team to good effect, but it works just as well for running an efficient home.

There are many strands to the whole concept. I will briefly explain:

Streaming, the idea that everything is progressed as a stream that is followed through from beginning to end – cooking, laundry, shopping;

Kaizen or continuous improvement where you look for ways to be more efficient and create solutions to any problem areas;

Muda, meaning waste and this encompasses anything from money, time or ingredients and especially the environment. Reducing this waste is particularly beneficial;

Seiri and 5S; Sort, set in order, shine or clean, standardise and sustain. This speaks for itself – wouldn’t we all love a home that ran itself efficiently by just following a few simple rules;

And lastly, you manage all this with the help of a simple Kanban board a home’s central dashboard if you like.

It is a while since I have really used these principles and I am eager to get back to streaming the management of our home again. Last year and 2024 were ususual years for us with a lot of coming and going with plenty of house selling and buying within the family and, as is quite the case, things move on and my systems and streams need an overhaul.

I have a few more areas of our finances to improve on and streamline before I move onto this months topic – our diet. You cannot have missed the number of TV programs, magazine articles and books all talking about the disadvantages of eating ultra-processed foods and the many advantages of eating well. It is something I researched last year and also signed up to the Zoe programme, started a few years ago by Tim Spector (who is also running the TV programme What Not to Eat). So no doubt I might have a few posts talking about my health journey.

But that is another day another post.

Have a good week everyone, back soon x

If you would like to leave a comment please click here.