Once again I am facing the moment of truth. Sometimes we can think we are doing well and spending less but the figures at the end of the month never lie.

Overall for February the total outgoing money was much the same as January but the amounts in each category had shifted around – a bit like the sand and pebbles on our beach at the cottage.

To summarise; the housekeeping, household bills, cards and gifts were lower than last month but fuel costs, eating out, health and wellbeing were higher.

The housekeeping money (which for me includes groceries, whole foods and supplements, magazines, cleaning supplies, toiletries, face creams, make-up, postage, stationery and flowers for the house when I buy any) came in at £367.00, but of course it was the shortest month so maybe this wasn’t a great achievement and remember I am not an all out frugal blog by any means (stop reading now if you were expecting severe thrift or you will be disappointed) – I like a bargain and I like to live within my means – I also like hanging on to my savings for dear life but I don’t particularly buy cheap in all cases in fact I like quality and value for money so I assess everything I buy with that in mind whether it be food, clothes or a garden tool.

I know there are many of you out there who would do much better than me but this is my way of cutting the spending down and buying less without making myself totally miserable or obsessed and I am pleased with myself if I find I have spent less than last month. I haven’t even set category budgets for myself – I suppose I should really but I know I have to stay within the bounds of our one state pension for most of our day-to-day living costs and save a bit if we can. When we have lived on the pension for a while and have definite figures to work on then I can adjust and budget.

So how did I do…

Transport and fuel costs

February was heavy on fuel costs not just for the car but during the warm spell we had recently we had to buy petrol for the mower in order to cut the grass! The trip up to Scotland and 2 round trips up to North Yorkshire increased this category to £180 ouch! In compensation there were no other transport or car related costs but we do have an MOT coming up next month.

Total costs of seeing the world and shaving the grass: £186.87

Health and wellbeing costs

February saw us both at the hairdressers for a cut and blow dry. We go to the same local hairdressers – not together I might add, that might be a little strange!….and whilst mine is £26, DH only has to pay £11 but then his hair is much shorter and he has less of it. For me it is worth the expense, I always feel much better afterwards.

Total cost of a brand new me and him: £37

Utilities

Our central heating and hot water runs on gas and we have a coal effect gas fire in the living room. The heating is on from 5 pm to 8pm – after that we will just put the gas fire on if it is really cold whilst watching the TV or sometimes for a bit of glow on the lowest setting. The gas bill for February came in at £69 plus VAT. I didn’t think that was too bad – helped of course by the milder weather and watching TV during the evenings wrapped snuggly in a throw rather than putting the fire or heating on.

Total costs for the joy of warm toes: £72.63

Grocery and housekeeping costs

Surprisingly I spent less this month than last (but then it was only 4 weeks long) however the average per week on groceries alone worked out at a little more than last month @ £77, (£309 for the month) but we did take advantage of a lot of items on offer so are pretty well stocked in the grocery department. Some weeks I do better than others and have more time to plan – sometimes it is all a bit rushed and that is when I do spend more but we have been having some nice meals recently and I have been trying new recipes. We had a surprise freebie in Tesco in Castle Douglas in Scotland when they were handing out free rolls one evening. You couldn’t beat this yellow sticker price!

We had a surprise freebie in Tesco in Castle Douglas in Scotland when they were handing out free rolls one evening. You couldn’t beat this yellow sticker price! I didn’t buy any toiletries or face creams during February but did treat myself to some flowers for the house.

I didn’t buy any toiletries or face creams during February but did treat myself to some flowers for the house.

Total cost to eat and be merry £361.87 and a bunch or two of cheerfulness £5.

Home and garden purchases

Once again just bits and pieces bought in this category but it still added up to an alarming £106 – I had to look twice at this in disbelief – but it is there in black and white and needless to mention this cost will be taken from savings not the pension – the pension does not allow for frivolous purchases that consist of:-

- 2 large storage boxes with lids for in the loft to replace some old cardboard bankers boxes

- 3 lidded craft storage boxes to hold our old slides

- 1 small 4 litre Maslin pan to make jam and marmalade reduced by £10 to £19.99

- 2 glass lidded containers from Muji for cotton wool and cotton wool buds (this was a definite treat); I love Muji products for their simplicity and have wanted these for ages and couldn’t resist when DH gave me the OK nod.

- Portable Muji diffuser – on offer at the Muji store – gives out 2 hours of real essential oil fragrance

- 2 Pillow protectors on sale in Sainsbury’s for £3.60 – decided against the dearer John Lewis ones and will return them.

This is certainly a category to watch – those little bits here and there add up to quite a lot.

Total cost for unavoidable household needs wants: £106

Gifts and card costs

Gifts and cards came in lower than last month – only a couple of birthdays and mum’s belated birthday book token. I already had a Valentine’s card and a stock of birthday cards and luckily none of the birthdays required a gift, so much cheaper month than last.

Total cost to gift away: £22.50

Crafts and hobbies

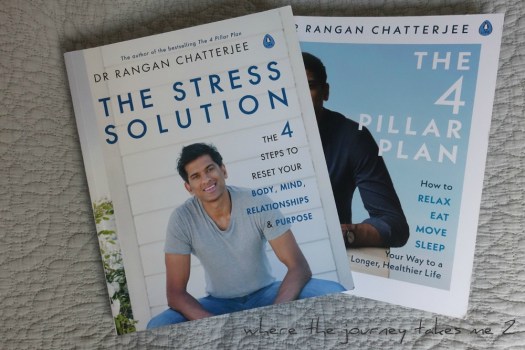

Confession – I bought two books (I include books in my Craft and Hobbies category). Simple Sewing posted here, and The Stress Solution by Dr Rangan Chatterjee. I bought his book The Four Pillar Plan a while ago and it is one of the best general health books I have read and continue to reread and am trying to put into practice.  I couldn’t wait for his new book to appear cheaper in The Works so splashed out the £8.49 in Sainsbury’s.

I couldn’t wait for his new book to appear cheaper in The Works so splashed out the £8.49 in Sainsbury’s.

Having tried a bit of crotchet with the hooks and wool I bought last month it became apparent I would not be making any baby clothes any time soon – I couldn’t even crotchet a square and will need more time to practice so I decided to try my hand at knitting again.  I bought a baby pattern £3.10 and 3 balls of Sirdar Baby Crofter from Hobbycraft @ £4 ball to make a jumper for Sweetie and now realise knitting your own is not a cheap option. DH just smiles!

I bought a baby pattern £3.10 and 3 balls of Sirdar Baby Crofter from Hobbycraft @ £4 ball to make a jumper for Sweetie and now realise knitting your own is not a cheap option. DH just smiles!

Total cost to keep me busy: £27.78

Leisure and Entertainment

I spent a worthwhile £15 on the pantomime tickets (no discounts even though I am related to the stars of the show!), however I do still have to pay my sister for these when I see her. Of course the petrol costs to get there would have been about £30 – but she is my sister and of course Libbie (Little L) was so thrilled.

Other than that our other entertainment this month was visiting Ikea – totally free!

Total costs of a good belly laugh: £15 (not including the fuel a definite boo!)

Eating out

This continues to be much reduced now we take picnics everywhere or get free drinks in Ikea – but is higher than last month as we had our trip to Scotland and bought a chip butty tea each on the way up and back £7.70. Mainly though our only regular expense is the pre shop drinks in Sainsbury’s café every week £4.10, DH always comes along with me now since I am no longer at work (probably to keep an eye on the spending!) so it doubles this little indulgence – if we gave this up we would be down to zero pounds unless we elect to treat ourselves for lunch out, which we did at Costa en route to the Pantomime.

Total costs to satisfy our healthy appetites: £52.25

Clothing and footwear

I bought a grey long-sleeved t-shirt from Sainsbury’s – it was, I am pleased to say, a considered purchase. I bought one last Autumn and love it so much I invested in another before they disappear, they are great to wear under a jumper and keep me snug and warm in the cold weather – so a small price to pay. I also needed to replace some old wornout black socks that I wear with my jeans and leggins. One pack of five from Tesco for £5 – they have the same patterned rib as the previous ones I bought two years ago which is great as I won’t need to spend time matching socks after washing them.

Total cost to looking totally glamorous presentable: £9.75

As you might expect the spending in the different categories has ‘see-sawed’ a bit this month. What was a low figure last month was higher this month and vice versa. I am enjoying the books, enjoying the knitting (more on this another day) and will no doubt enjoy making some jam and marmalade.

So a few new items have entered my home but what has gone out…I will reveal later.

As usual hoping to do better next month and any advice is always welcome….xx

If you want to read January’s tally click here

So although I didn’t think I was buying anything very much over the month obviously the spreadsheet tells a different story.

So although I didn’t think I was buying anything very much over the month obviously the spreadsheet tells a different story.