Yesterday saw us in Leeds attending 3 seminars delivered by the financial advisors Hargreaves Lansdown – you may have heard of them they are a pretty big national company. The seminars were free – so seemed a waste not to go – after all any advice is better than none.

I must admit I am so glad we attended – we came away with much food for thought.

We decided on using the Park and Ride as the seminars covered most of the day and parking in Leeds is not only difficult but expensive with a capital E. It worked well and I would use it again – the buses were clean, quiet and driven by a lovely helpful man and we did not have to wait long coming or going. Cost £6

The snacks and drinks we had to buy during the day to keep us going were not very cheap – we took sandwiches which we ate at 11am in the car as the first seminar was 12 noon to 2pm, after that it was places like Costa for a toastie. The event finished at 8.30 so we had to cover food for all day although they did lay on tea and coffee and some chocolate chip cookies. Cost for drinks and eats out a hefty £17.

I know some of my readers are in the same place as me or coming up to retirement – some of you will be lucky enough to have final salary or public sector pensions – every ones means are different and that is the message that came out of the seminars. I am in no way promoting or recommending Hargreaves Lansdown – I am certainly not being sponsored by them nor am I advising anyone in any way.

The three seminars were entitled –

- Planning for retirement,

- Looking to make the most of your money in retirement

- Passing your wealth onto your loved ones (presuming you have some money left).

We thought we did not have enough wealth to warrant advice but the truth is when you add up your assets – your house, car(s), caravan, any valuables, savings, shares etc (especially if you live down south where property prices are higher) you may find that they exceed the £325,000 inheritance tax allowance and so when you (or both of you) pass away the tax man will claim his 40% first on the excess and this can work out more than any individual beneficiary receives. Thinking ahead can help to preserve more of your estate for your children’s / grandchildren’s benefit.

There are it seems many legitimate ways to protect some of the money that you might pass on to loved ones by means of a trust. I did not know anything about trusts and they may not be applicable to us but it was interesting to learn more about them.

One of the main points I came away with was I do wish we had been more attentive when we were younger and thought seriously about putting more of our surplus money into a private pension pot. Anyone younger reading this I would say get to know more about pensions now and act on it – you will not easily sustain the standard of living you have got used to, when you leave paid work and retire on just the state pension – so don’t rely on it. That is not to say you cannot live fairly comfortably on a state pension – my grandparents did well enough but there are no frills attached.

Obviously for us this cannot be reversed now and I remember when we were younger we did not have a lot of spare cash – we had mortgages with hefty interest rates in the 80’s and two growing girls – pensions were not on our mind but should have been and I am sure we could have squeezed a little more out of the monthly budget to put away.

But we are where we are and part of the seminar was to think about how much money we really need to live on now and during the rest of our life (of course not knowing how long this might be is a bit of a key factor in this game) and are we going to meet that income with the pension we have or is there likely to be a major shortfall. For instance if you want to travel to exotic places or keep a high standard of living going or remain in a big house this may cause a large shortfall.

I just need to know I can enjoy my retirement and be comfortable, have a few good holidays and follow one or two hobbies and if anything unexpected happens we have the means to deal with it – I am not expecting to live it up exactly but if there is a shortfall or we need expensive care costs how can we generate more income to bridge the gap. There are only a few ways to receive more income during retirement – for most of us this would be through savings generating interest, investments generating dividends, or rental income (if you are lucky enough to have another property or inherited one), you might be lucky at gambling or bingo but at worst you might need to go back to work.

Another fact I had not considered is that different governments will have a future effect on our money – some will want more than others in tax. That will not alter the choice of party i vote for but is something to be aware of.

Since 2015 the flexibility of accessing our private pension pots has greatly increased but with it a lot of complexities and the goal posts change yearly with the budgets so you need to be mindful of these changes.

The speaker, who was extremely knowledgeable, took the time to explain about the merits of the relatively new drawdown pension scheme in contrast to taking the traditional annuities. The advantage of drawdown is that it passes on to your beneficiaries which annuities do not. This pension pot is there to draw on if and when you need to but if most of it is left invested it can generate more capital growth to create an income stream (something I had not considered as I had been under the impression that capital was something that just ran down steadily in retirement).

The downside of a drawdown pension is that the money continues to be invested and so needs managing and if not by yourself by someone else at a cost. If not managed well you could run out of funds unlike an annuity which gives you a set guaranteed amount monthly for life – it is a secure amount but you need a decent sized pension pot to receive a decent monthly payment in the current climate.

On the risk side I learnt that you cannot assume that having your money in cash just gaining interest is low risk – this is actually very high risk as that money although safe will undoubtedly not keep pace with inflation and if you live another thirty years will be worth very little and might only buy you a cup of tea in the future.

The best way we were told to minimise risk is not to put all your eggs in one basket – invest your money in a whole range of ways. Sadly, this is not a simpler option and as you know I am looking for simplicity in all areas of my life but we live in a complex world so it feels pretty unavoidable.

We came out feeling much more informed if not a little overwhelmed – but like everything else we need a plan – so during this next week we are going to seriously plan our strategy and have a go at a lifetime cashflow chart as they suggest.

We arrived home to find two letters – a bank statement for our bill account, all as expected, and one from DWP notifying us of a rise in our state pension from April of £4.25 a week, about £18 month – when I budget I will work on the old amount not the new – this rise of £18 will go straight to savings.

A day of potential doom and gloom – (but made better by the free freshly baked cookies and an unexpected rise in income). x

We had a surprise freebie in Tesco in Castle Douglas in Scotland when they were handing out free rolls one evening. You couldn’t beat this yellow sticker price!

We had a surprise freebie in Tesco in Castle Douglas in Scotland when they were handing out free rolls one evening. You couldn’t beat this yellow sticker price! I didn’t buy any toiletries or face creams during February but did treat myself to some flowers for the house.

I didn’t buy any toiletries or face creams during February but did treat myself to some flowers for the house.

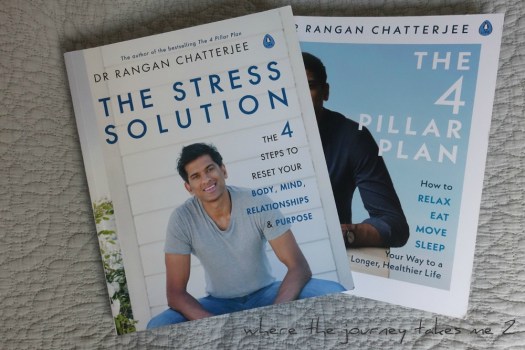

I couldn’t wait for his new book to appear cheaper in The Works so splashed out the £8.49 in Sainsbury’s.

I couldn’t wait for his new book to appear cheaper in The Works so splashed out the £8.49 in Sainsbury’s. I bought a baby pattern £3.10 and 3 balls of Sirdar Baby Crofter from Hobbycraft @ £4 ball to make a jumper for Sweetie and now realise knitting your own is not a cheap option. DH just smiles!

I bought a baby pattern £3.10 and 3 balls of Sirdar Baby Crofter from Hobbycraft @ £4 ball to make a jumper for Sweetie and now realise knitting your own is not a cheap option. DH just smiles! So although I didn’t think I was buying anything very much over the month obviously the spreadsheet tells a different story.

So although I didn’t think I was buying anything very much over the month obviously the spreadsheet tells a different story.